In today’s corporate landscape, regulatory scrutiny, shareholder expectations, and evolving business dynamics demand accurate and transparent governance decisions. Boards are increasingly held accountable for how they structure remuneration, select directors, and benchmark leadership compensation. GovernEx, Imbibe Technologies’ proprietary governance intelligence platform, was developed to address these modern challenges—combining structured market data, real-time benchmarking, and dynamic visual reporting to help companies make confident, data-backed boardroom decisions. This case study highlights how a publicly listed Indian company used GovernEx to overcome governance inefficiencies, enable dynamic remuneration planning, and align its board and executive pay with both regulations and stakeholder expectations.

🧩 The Business Challenge

The client, a high-growth mid-cap company listed on Indian stock exchanges, faced the following challenges:

📉 Outdated Peer Comparisons

The company’s internal benchmarks for CEO and board compensation had become static and outdated, failing to keep pace with its rapidly growing market capitalization. As peers evolved and compensation structures shifted, their comparisons no longer provided accurate or credible context—leaving the board vulnerable to criticism during performance reviews and AGMs.

🗂️ Manual Data Compilation

Collecting board remuneration data meant digging through annual reports, proxy statements, and public disclosures—a process that was slow, fragmented, and error-prone. Not only did this consume significant administrative time, but it also created the risk of inaccuracies that could undermine trust in their analysis.

🔮 Lack of Predictive Insight

Without the ability to anticipate future shifts in peer compensation, the company was left reacting year over year rather than planning strategically. This lack of predictive modeling made AGM preparation more difficult, limiting the board’s ability to justify decisions with foresight and authority.

⚠️ Pressure from Investors and Proxy Advisors

Shareholders, investors, and proxy advisors were increasingly demanding a transparent, data-driven approach to board and executive remuneration. Without robust analytics and clear benchmarking, the company faced mounting scrutiny and reputational risk if compensation decisions appeared misaligned with shareholder expectations.

The company needed more than just a replacement for their outdated process—they required a flexible, intelligent solution that could evolve with their growth. Instead of relying on static benchmarks and error-prone manual data gathering, they sought a platform that would deliver real-time, accurate, and predictive insights into peer compensation trends.

✅ Our Solution – GovernEx

GovernEx provided a fully integrated, intelligent governance platform designed to deliver actionable insights on executive and board remuneration. Deployed with four powerful capabilities, it was tailored to the client’s specific needs:

📊 Remuneration Benchmarking Engine

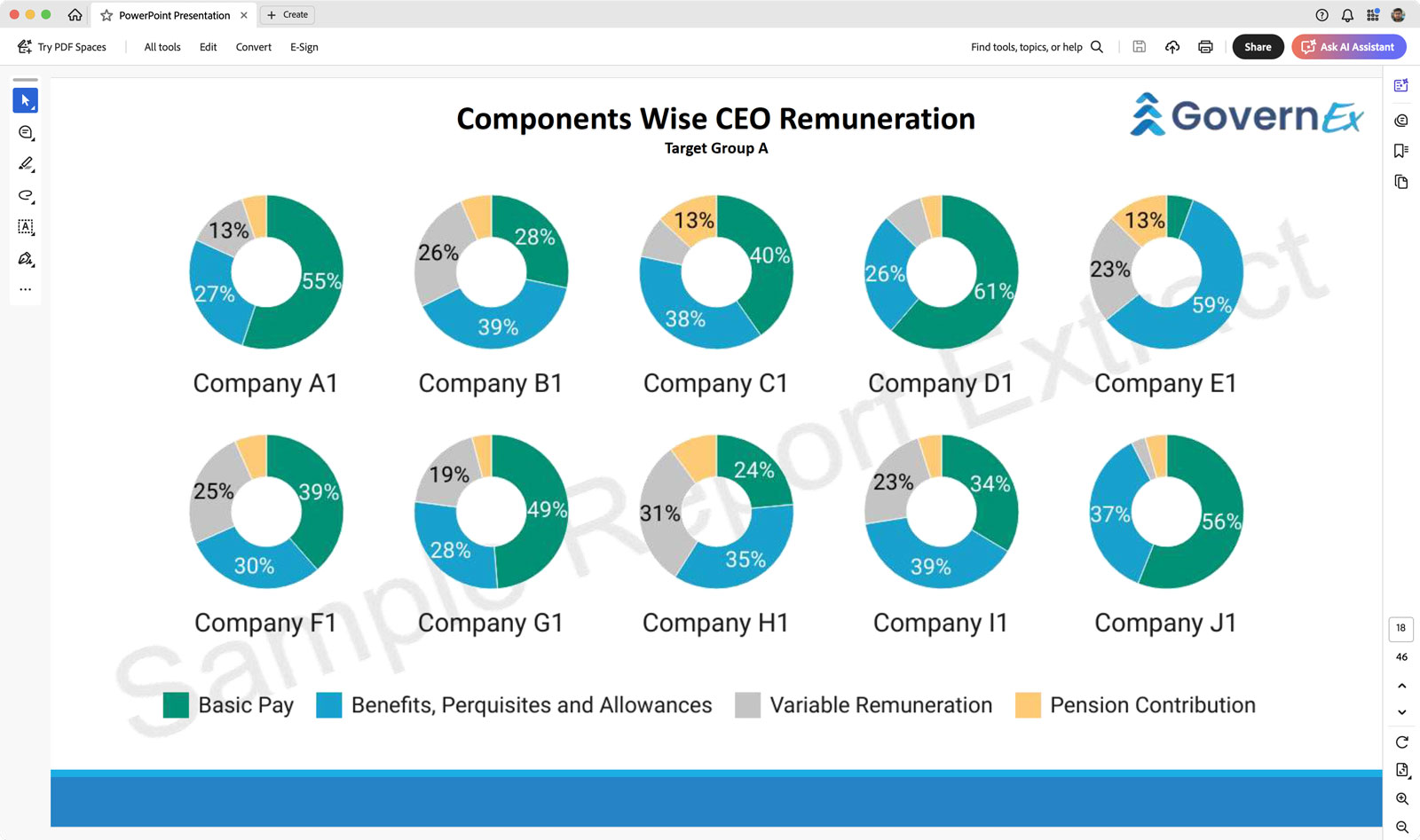

GovernEx streamlined benchmarking across:• CEO compensation packages (base salary, perquisites, allowances, retirement benefits, additional perks)• C-level pay (CFO, CSO, CMO, and other top executives)• Board remuneration (Chairperson, independent directors, committee roles) The system generated quartile-based comparisons with peer companies, filtered by Market capitalization, Sector / industry and Listing status.

🔗 Dynamic Peer Grouping

GovernEx enabled benchmarking against three strategic peer groups:• Target Group A: Companies of similar size and listing type• Benchmarking Group 1 & 2: Larger or aspirational peers for forward-looking comparisons This flexibility allowed the client to adapt and scale their benchmarking strategy as the business grew.

🔮 Predictive Remuneration Insights

By leveraging historical and cross-sectional data, GovernEx delivered predictive intelligence that provided:• Early signals of expected pay increases across roles• Data-backed support for AGM planning and stakeholder communications This transformed their approach from reactive to proactive.

📑 Board-Ready Reporting

GovernEx simplified stakeholder communication by generating clear, board-ready reports, including:• Salary positioning vs. peers• Year-over-year shifts in remuneration• Committee fee structures• Peer group quartile distributions These insights ensured the board was always prepared with data-driven justifications.

🎯 Results Delivered

Through GovernEx, the client transformed its governance and remuneration processes, moving from manual, reactive practices to a data-driven, proactive strategy. The impact was immediate and measurable:

✅ Strategic Positioning

The company successfully realigned CEO and board compensation within the upper quartile of its peer set. This not only supported a competitive talent retention strategy but also strengthened its narrative around fair and market-aligned pay practices.

⏱️ Time Efficiency

By automating data aggregation and reporting, GovernEx reduced reporting cycles from 6–8 weeks (manual, Excel-based process) to under 3 weeks. This freed up leadership time for strategic discussions instead of administrative work.

📊 Data-Backed AGM Preparation

GovernEx reports became an integral part of NRC meetings and shareholder briefings, providing transparent, evidence-backed justifications for executive and board compensation decisions. This ensured AGMs were structured, efficient, and defensible.

🛡️ Compliance Readiness

GovernEx flagged a pending committee imbalance well ahead of the AGM, allowing the company to take corrective action proactively. By addressing the issue early, they avoided potential regulatory scrutiny and investor pushback.

🤝 Stakeholder Confidence

With GovernEx’s transparent and data-driven insights, the company built trust with proxy advisors, institutional investors, and shareholders. This improved perception of the board’s decision-making and enhanced overall stakeholder confidence.

👉 Conclusion

GovernEx transformed the client’s governance and remuneration processes—turning fragmented, manual efforts into a structured, real-time decision-making workflow. With clear insights, robust benchmarking, and compliance support, the company elevated its board effectiveness and strengthened investor trust.As board accountability grows, GovernEx continues to help companies lead with transparency, precision, and strategic foresight.